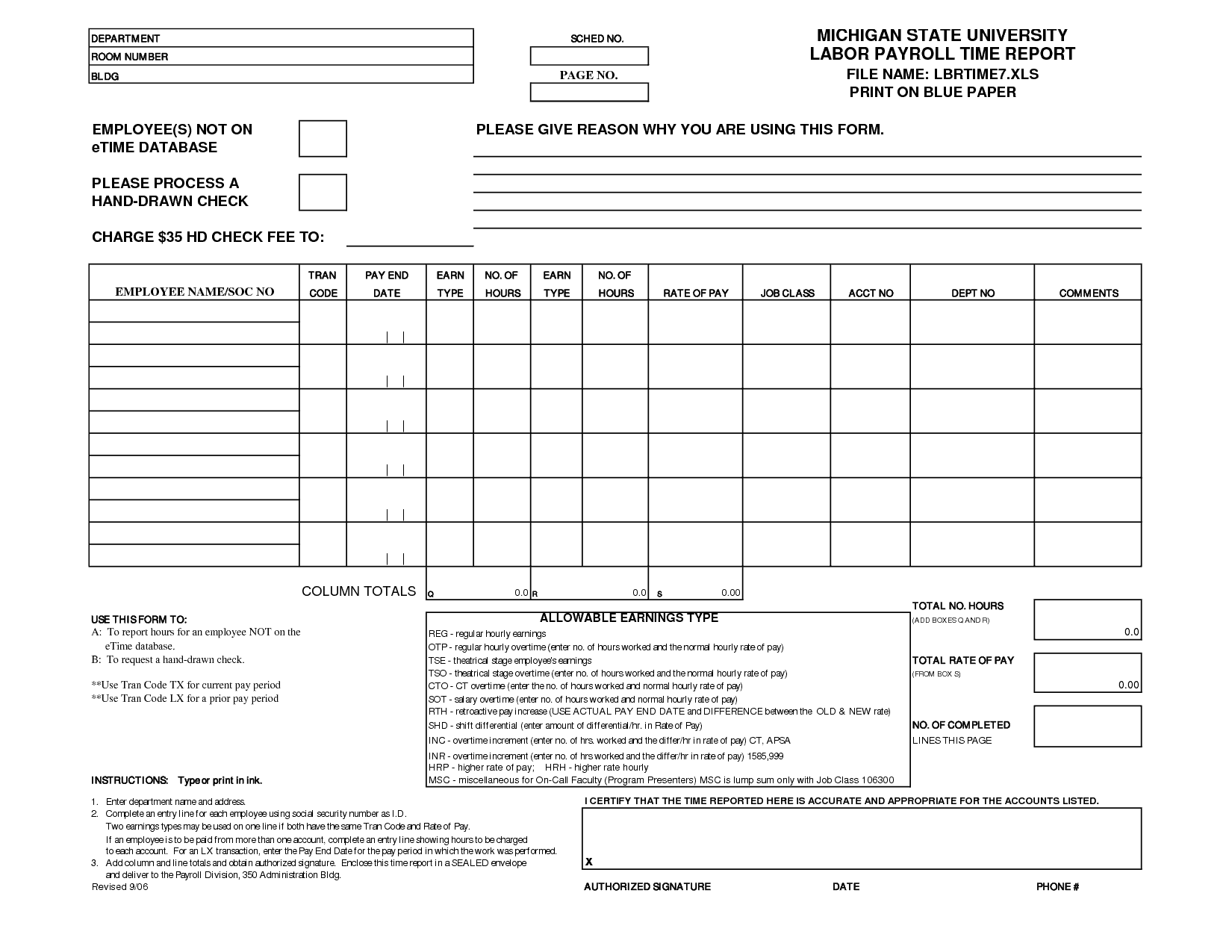

Payroll is the amount must be paid to the workers or employees by the employer; it can also be termed as wages. Payroll is consideration paid to the employees for their services, in accordance with the work done. Payroll can be on weekly or monthly basis or according to a certain project. In the business all the employees are being paid according to their decided wages or pays, counting their working hours. Different tools and applications are available to create payroll or it can be created according to the demand. You can also get a payroll template from internet.

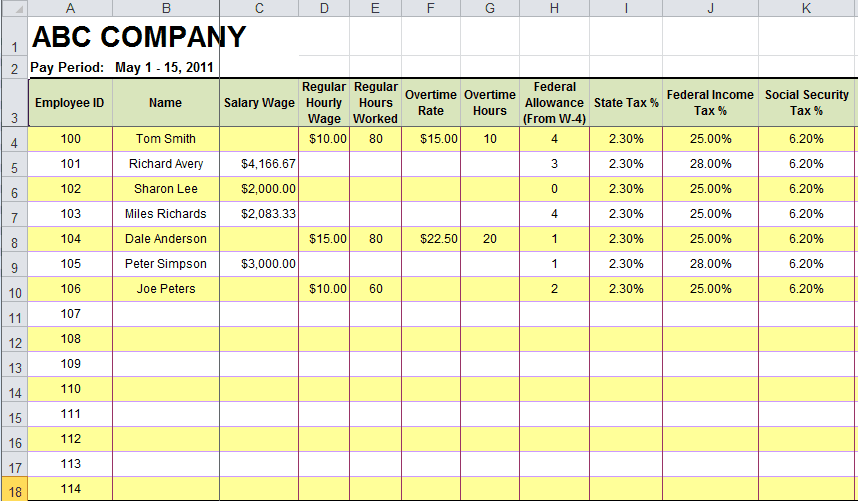

Once you are done with selecting a payroll template, either you have created yourself or got it from internet, you have to fill in the names of the employees you have. The first column should be having names of the employees; next column should be reserved for the hourly wages, and then mention tax status in a separate column. There could be different kind of columns reserved for different purpose, for example if there is any state tax federal allowance, it must be mentioned in the payroll, such type of any other information must be there.

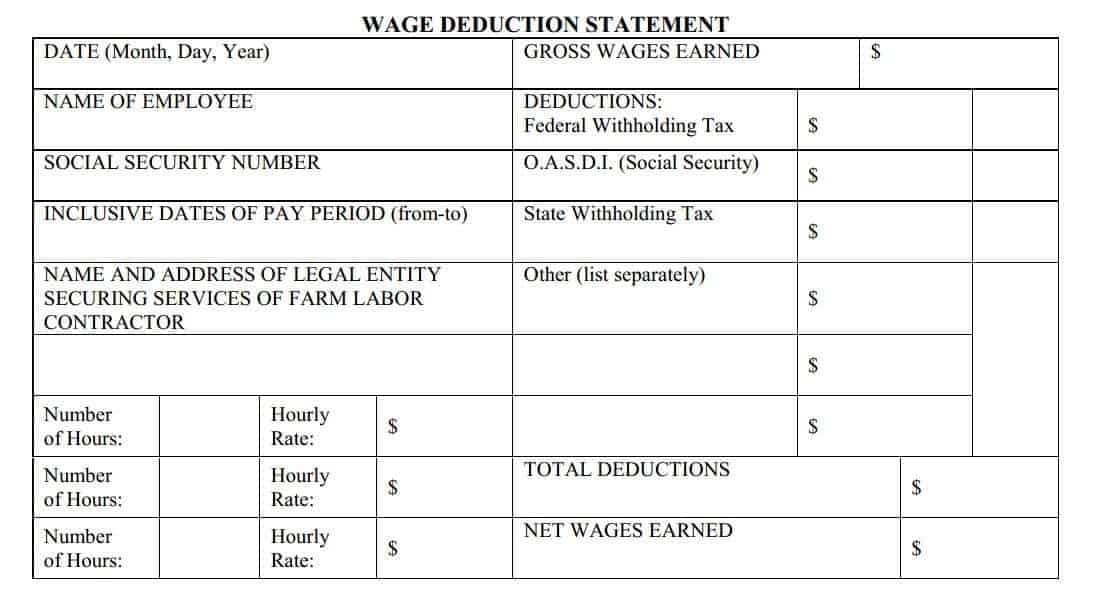

If there is any kind of deduction from the pay, it must be mentioned properly. Make sure that you enter complete information of your employees, without leaving any aspect incomplete. Then rest is up to your tool, calculator or application to calculate your pay or wages according to your working hours. Such kinds of applications are based on the data you have entered previously, so make sure that you enter exact data of each employee for a proper payroll. Payroll template is the easiest way to handle the money matters and to pay the exact amount to the employee according to their working hours. A sample of payroll has been attached here for your help.

Find Payroll Templates Here

[ezcol_1half]

Blank Payroll Template

[/ezcol_1half] [ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]

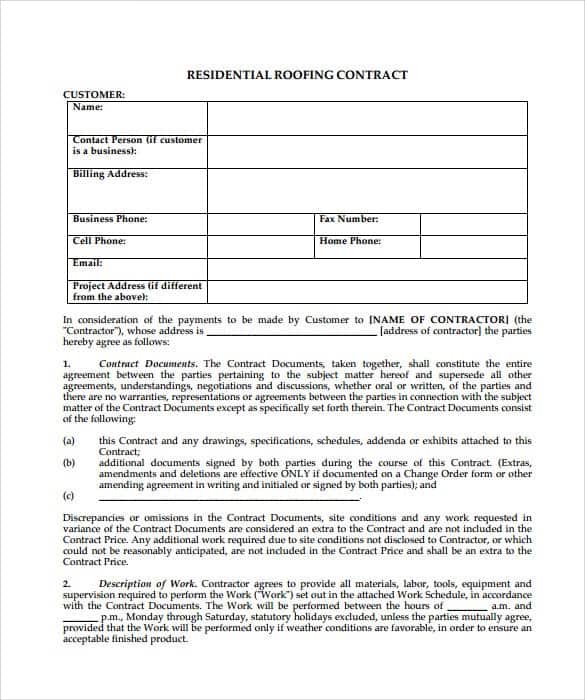

Payroll Template Excel

[/ezcol_1half_end]

[/ezcol_1half_end]

[ezcol_1half]

Employee Payroll Template

![]() [/ezcol_1half] [ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]

You must be logged in to post a comment.