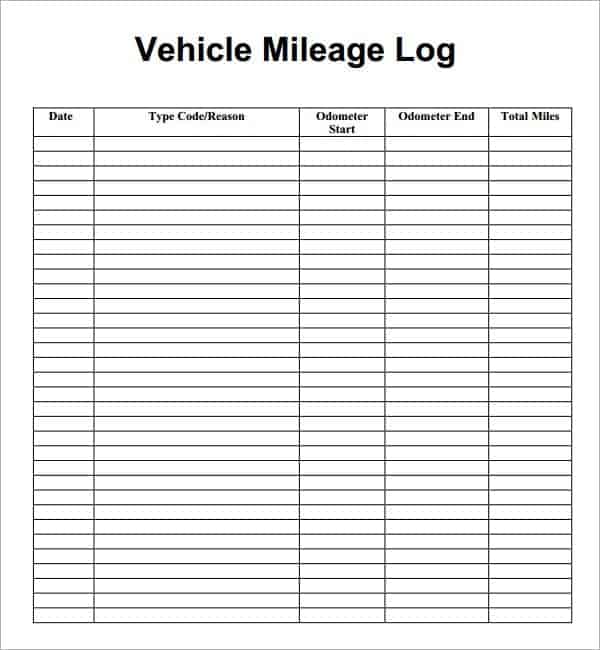

Vehicle expense log can come in handy when it is important to keep track of vehicle expenses that you are using for business purpose. Tracking of vehicle expenditures is beneficial for variety of reasons. An employee of the company or business can get all vehicle related expenses reimbursed in full by showing all travel expense related details and information in form of vehicle expense log. It provides you a best way to ask your employer or company for fuel or traveling allowance by showing how much you are spending on vehicle each month.

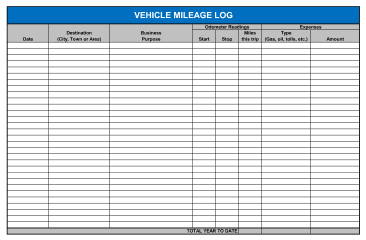

Business organizations and companies using more than one vehicles for business purpose are suggested by experts to create vehicle expense log for each and every vehicle because it is important to get mileage deduction on tax return. A carefully created vehicle expense log template helps professionals and business settings to keep good and detailed record of vehicle related costs and expenses to calculate total vehicle expanses at the end to get reimbursement. If you have MS excel in your computer then it will be easier to make vehicle mileage log from scratch but it may consume lots of your precious minutes. Use of vehicle expense log template is suggested for you to get it done only in few moments.

Your company will only pay off vehicle expenses based on details and information available in vehicle expense log so always be careful to record vehicle expenses in the log accurately to prevent troubles at the time of getting reimbursement for vehicle related costs. An individual person can also use vehicle expense log in order to prepare budget to spend on vehicle each month. By doing this, one can reserve a particular sum of money for vehicle related expenses to keep the vehicle in useful condition.

Here Are Free Vehicle Expense Logs

[ezcol_1half]

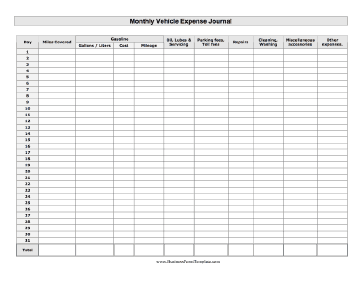

Vehicle Expense Log Template

[/ezcol_1half] [ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]

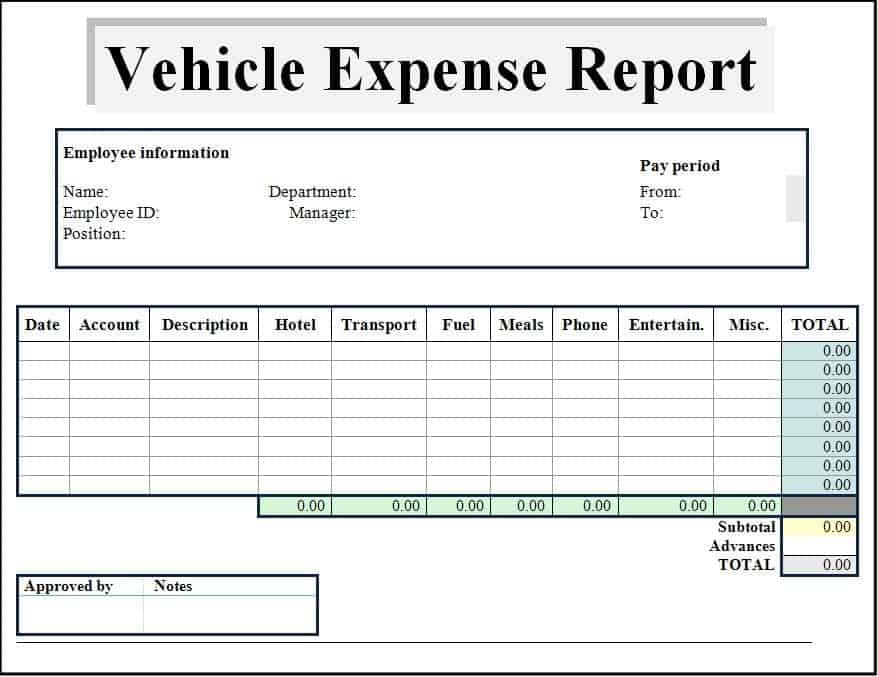

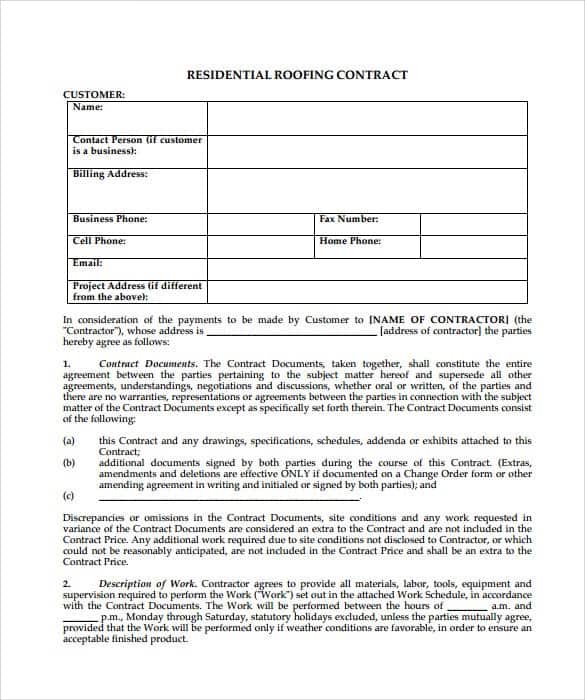

Vehicle Expense Report

[/ezcol_1half_end]

[/ezcol_1half_end]

[ezcol_1half]

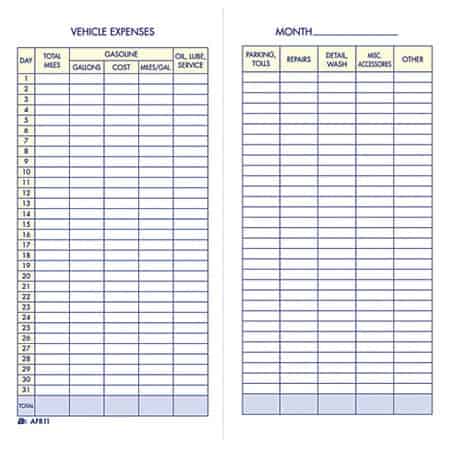

Vehicle Expense Log Sample

[/ezcol_1half] [ezcol_1half_end]

You must be logged in to post a comment.