Amortization is an accounting term, which refers to the allotment or to limit the cost of an intangible asset over a certain period of time. Theoretically, it is quite similar to depreciation and depletion although depreciation and depletion is charged over tangible assets after subtracting the residual value of an asset. Since intangible assets are considered not having a residual value, therefore the full amount of the asset is amortized. Moreover, if the intangible asset is goodwill,you can not amortize it in any condition because it is an unidentifiable or indivisible asset.

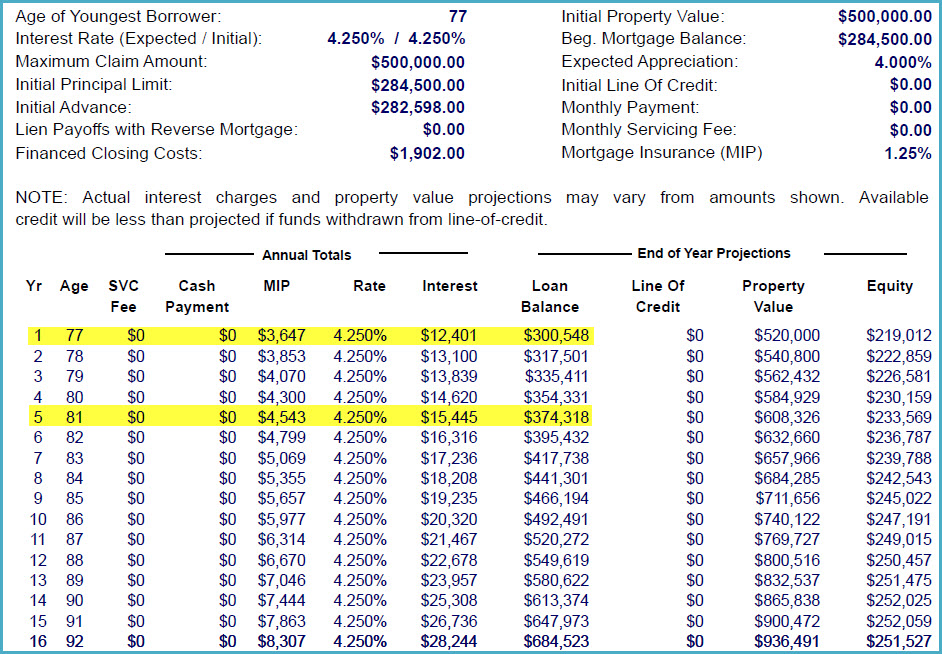

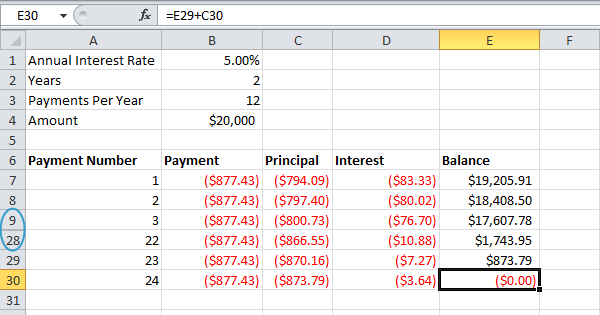

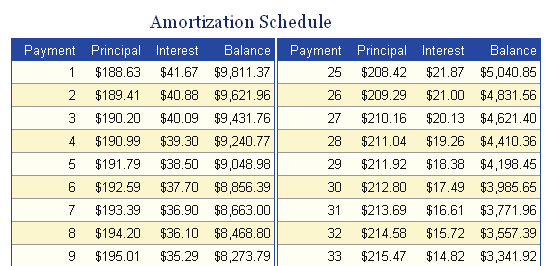

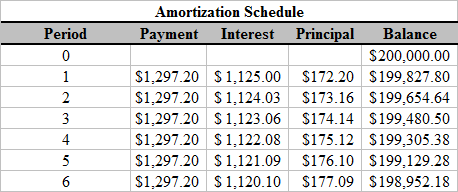

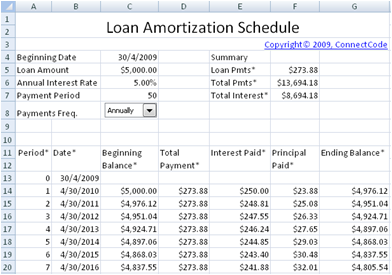

An amortization schedule excel is a schedule or table showing a payment on each amortized loan, payment of interest on it and the amount considered as original or principal amount. There are different amortization calculators available on internet (as shown in our templates below). After choosing a suitable one for you, you can make your own amortization schedule easily using blank spreadsheet as Microsoft Excel is considered a suitable software for this purpose.

If you want to create a basic amortization schedule in Microsoft Excel , at first, you need to collect the information which is essential to calculate the loan’s amortization, after collecting the information, you require principal amount and the interest rate fixed on it. Now add your loan rate in the form of percentage. Finally calculate your ending balance. This schedule clearly shows that how much amount is going toward your principal balance and how much interest you are going to pay on. Here are some amortization schedule templates given below so that you can make your own schedule easily.

Find Amortization Schedule Templates Excel Here

You must be logged in to post a comment.