Budgeting for business is an important task. Business budget is the process of preparing a comprehensive statement of financial results, that are estimated for a specific time period. It is one of the most potential monetary tools suitable for both short term and long term business. Business budget is usually prepared for a month, half year or year. Business budget instruct the employees of a firm that what actually their jobs are and how they are supposed to perform them.

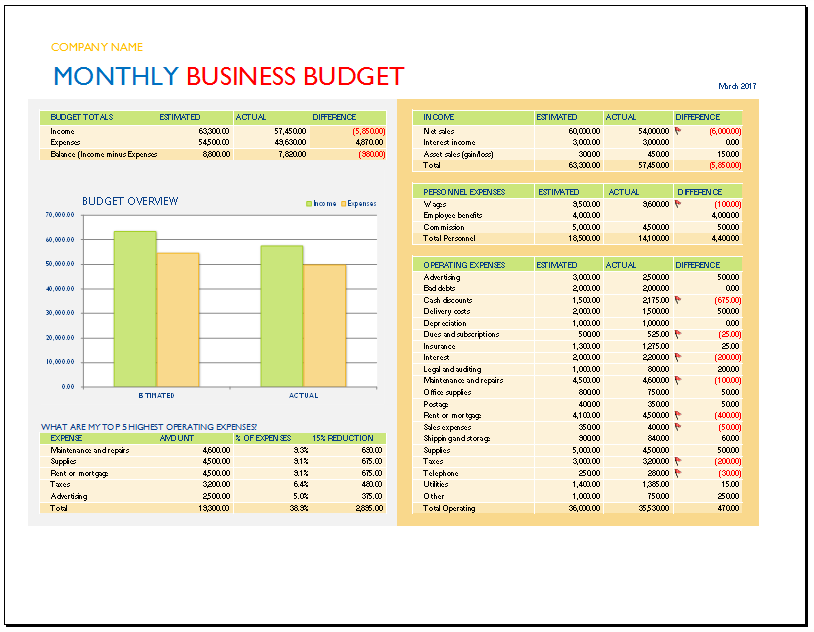

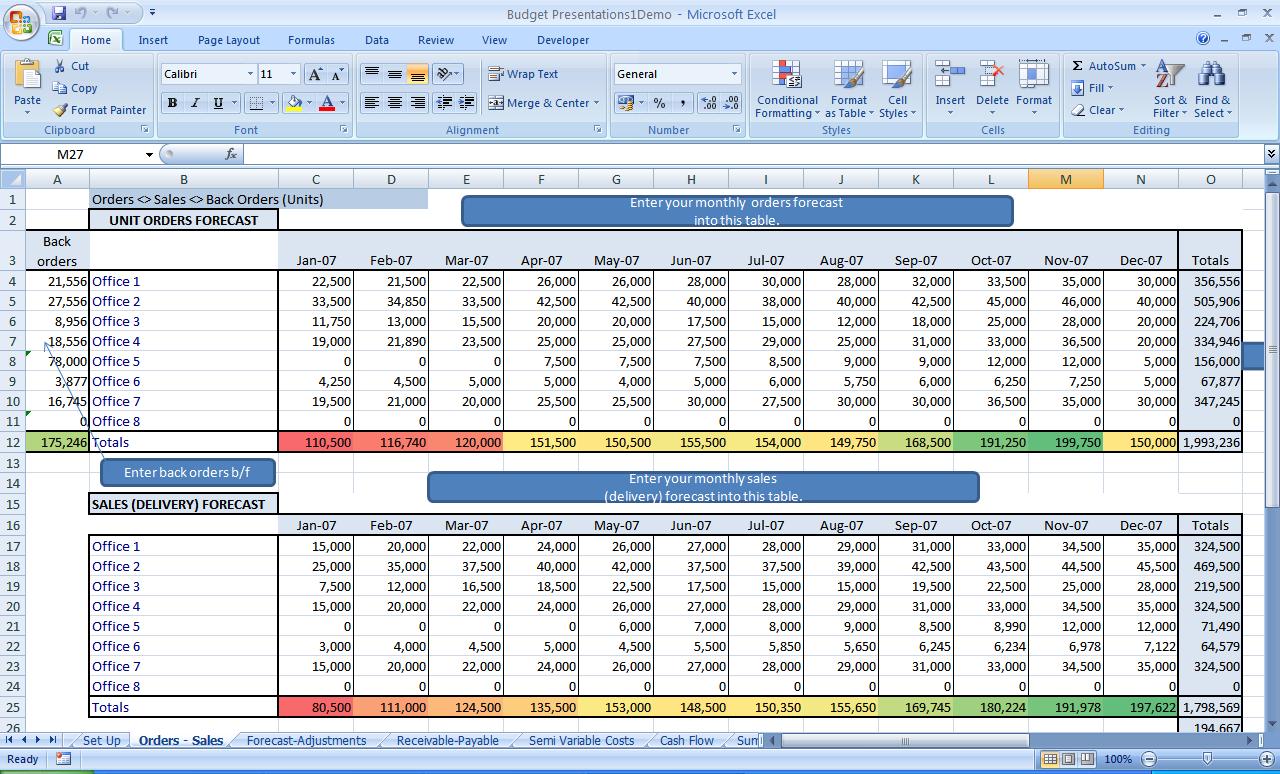

While starting and running your business, you will need to make a budget just like personal budget and business budget template is a handy too that will help you in this regard. Business budget is one of the most basic and effective tool to organize and track your business budget. It requires incomes including sales and interest, all variable expenses (that takes place on daily basis) and fixed expenses (mortgage, utility) etc. Budget for business usually consists of separate columns for actual and budgeted incomes and expenses, in that way you can see how budget works out throughout the whole period.

Entering all expenditures and incomes by category you will be able to keep in view your financial inflow or outflow, or you can make adjustments accordingly. There are three most important types of business budgeting that every firm should use. These are capital budgeting, operating budgeting and cash flow budgeting. Capital budgeting is for the fixed assets and large expenses, in the operating budgeting you have to determine what you require in your sales and revenues in order to meet your expenses, whereas, cash flow budgeting forecasts the cash inflow and outflow activities over the period. Are you going to fix your business budget? Try our free business budget templates listed below and use them at your ease.

You must be logged in to post a comment.