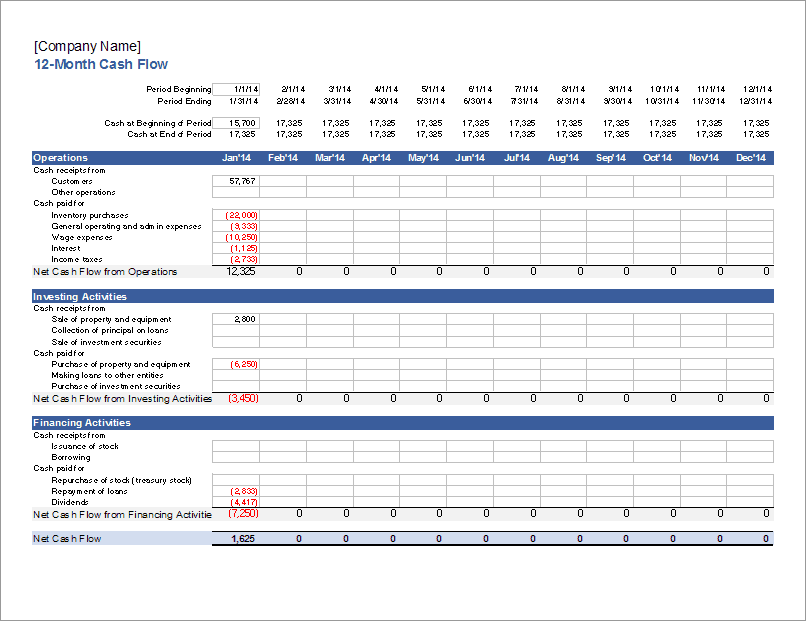

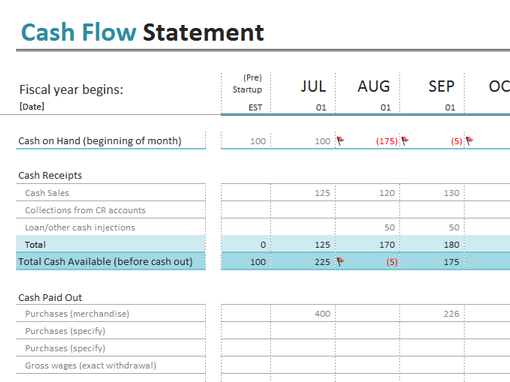

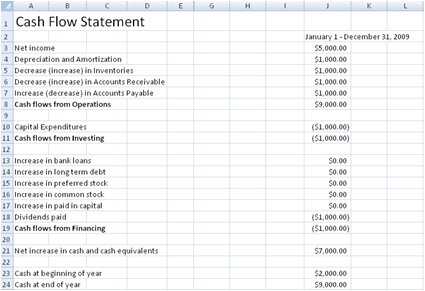

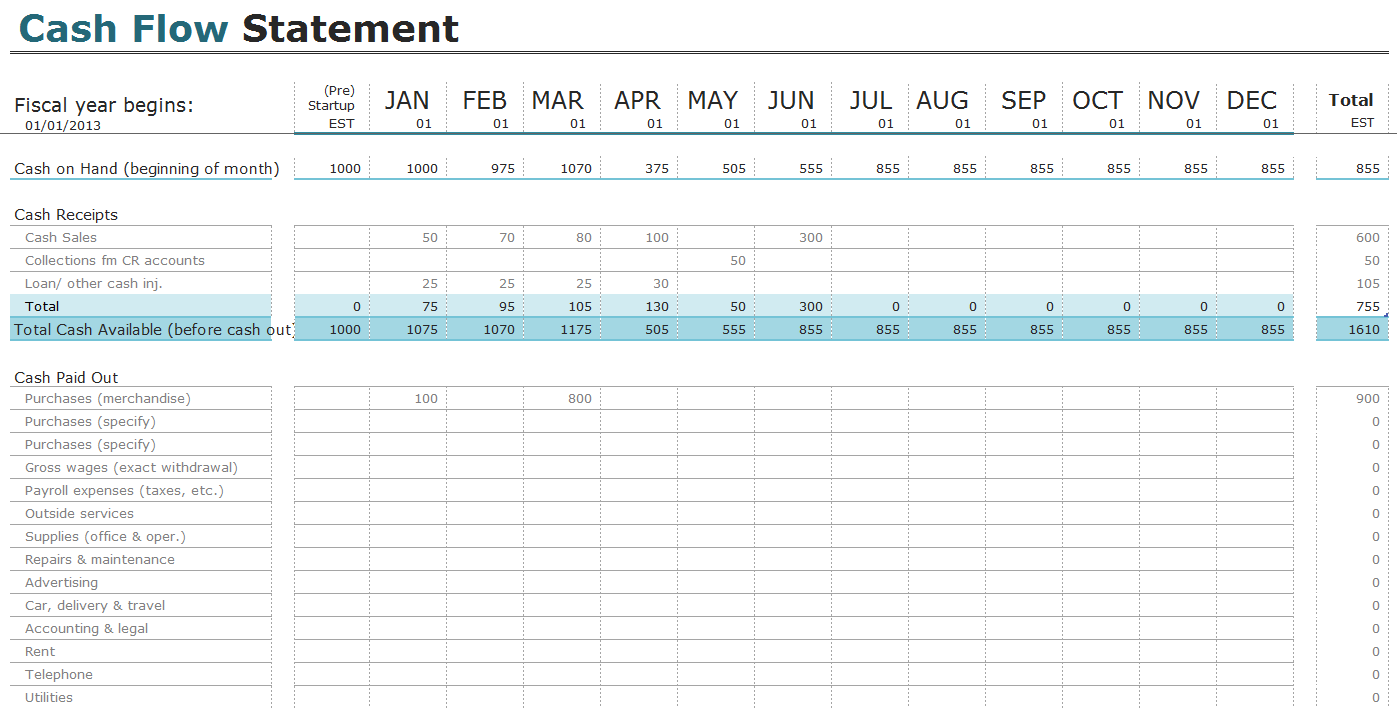

Along with the balance sheet and income statement, the cash flow statement is an obligatory part of a company’s financial reports. It records the inflow and out flow of cash resulting from various operating, investing and financing activities during a particular time period (usually a year). Here the term cash refers to the both cash and cash equivalents i.e checks yet not deposited, petty cash, saving accounts etc. These cash equivalents are readily convertible to cash. Cash flow is determined by these three components by which cash enters and exits the company.

Making a financial statement is not a difficult task, you can learn to make it from a cash flow statement template available on internet. The Cash flow statement will allow investors to understand how a company’s operations are flowing, where the money is coming from, and how it is being consumed. Moreover, you will learn how the cash flow statement is created by using our cash flow templates given at the end and how to utilize it as part of your company analysis. The cash flow statement does not include the amount of future incoming and outgoing cash that has been recorded on credit account.

By using cash flow statement template, you will obtain relevant information for estimating a business’ liquidity, standard of profits and deficiency. It helps to maintain a budget of the company and for investors or depositors, it reflects a company’s financial position over mentioned time period on its top. By adjusting earnings, revenues, assets and liabilities, the investor able to see the current situation of a company which some people think the important aspect. Given below cash flow statement templates can be downloaded and used for any type of business. You can customize any of them to include the specific types of cash flow activities that apply to your company.

You must be logged in to post a comment.