Debt reduction calculator is a tool, which enables you to estimate that how soon you can pay-off your debts by using a range of policies. This range includes debt snow ball (lower balance first) or debt avalanche (highest interest rate first) approaches. When a debt is paid off, the amount of payment is applied to the debt, which is available for use rather than another debt, which is referred as the rollover strategy. Debt reduction calculator enables you to create an amortization schedule so that you can record your financial worth to pay off debts. This will surely help you if your payments are in line according to your plan.

Debt reduction calculator helps you to figure out that how much time it will consume to get rid out of your debt, and how much amount and money you will save by adding a fix amount of additional money to each payment. After you start your debt reduction, There are a number of methods you can maintain it. The first step to make a debt reduction plan is to make a budget and follow it. The more congested your budget is to boost up your debt snowball, the quicker you will achieve your aims.

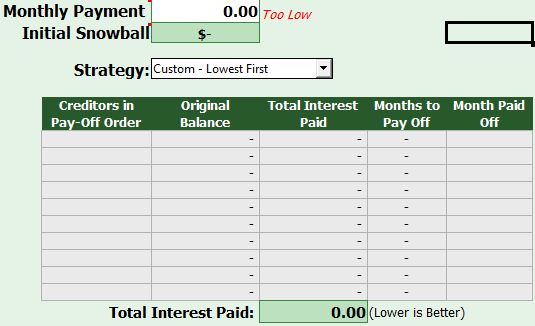

Debt reduction calculator uses the debt overdue, annual interest rate fixed on debt and the additional payment, to calculate the amount, as well as time, saved by adding money to each payment. You have to enter the minimum amount of payment you will make every month for each debt. The difference between total minimum payments and total monthly payment is your extra payment. Use our debt reduction calculators to dispose of your auto loan, student loan, credit card loan and other various debts. These calculators are handy and easy to use.