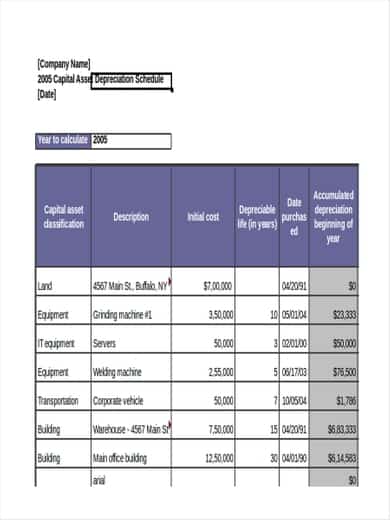

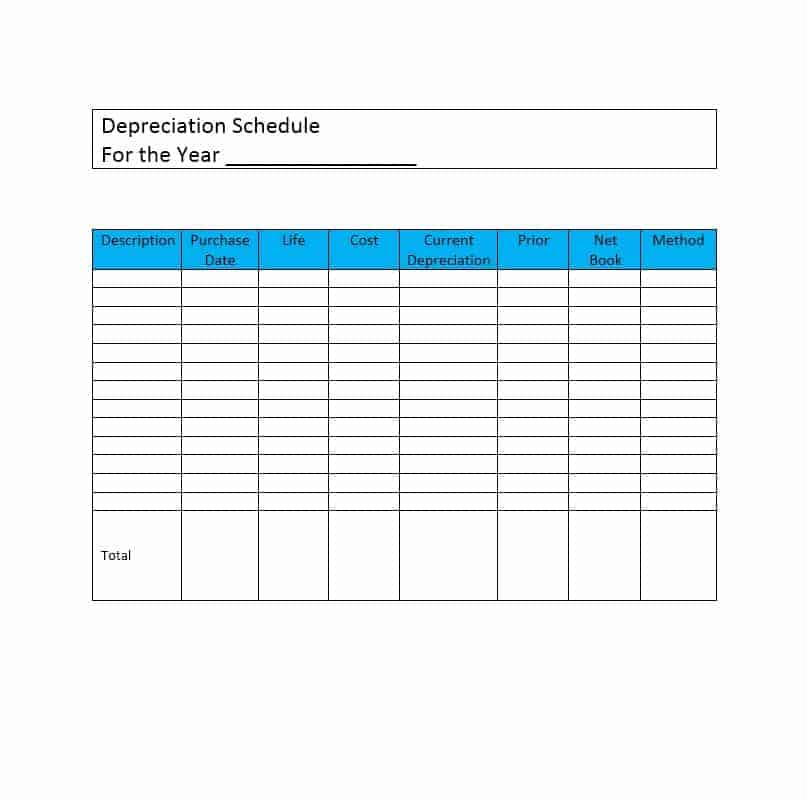

Depreciation schedule is a systematic and an accounting operation, for calculating the amount of book value of a fixed asset. You can download multiple depreciation schedule templates here free. When depreciation expense is recorded on the income statement of the company or business, its impact is recorded in the separate account, then disclosed in the balance sheet as accumulated depreciation. Accumulated depreciation is considered as contra account. Without the accumulated depreciation account on the balance sheet, depreciation expense is charged against the related asset directly. Use of a depreciation schedule makes it easier to calculate depreciation for all assets you have in your company or business. Depreciation schedule templates download links is down below.

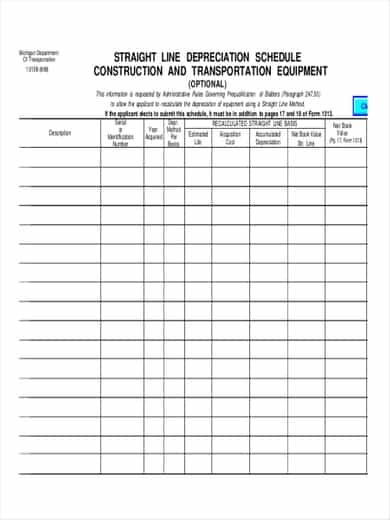

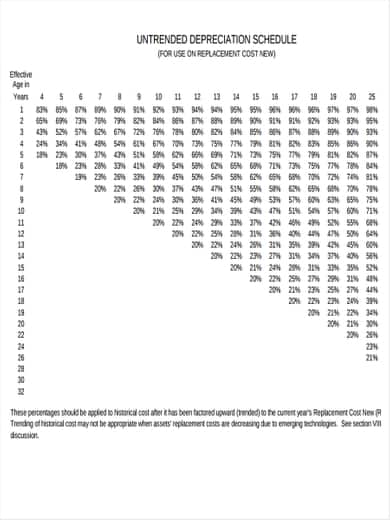

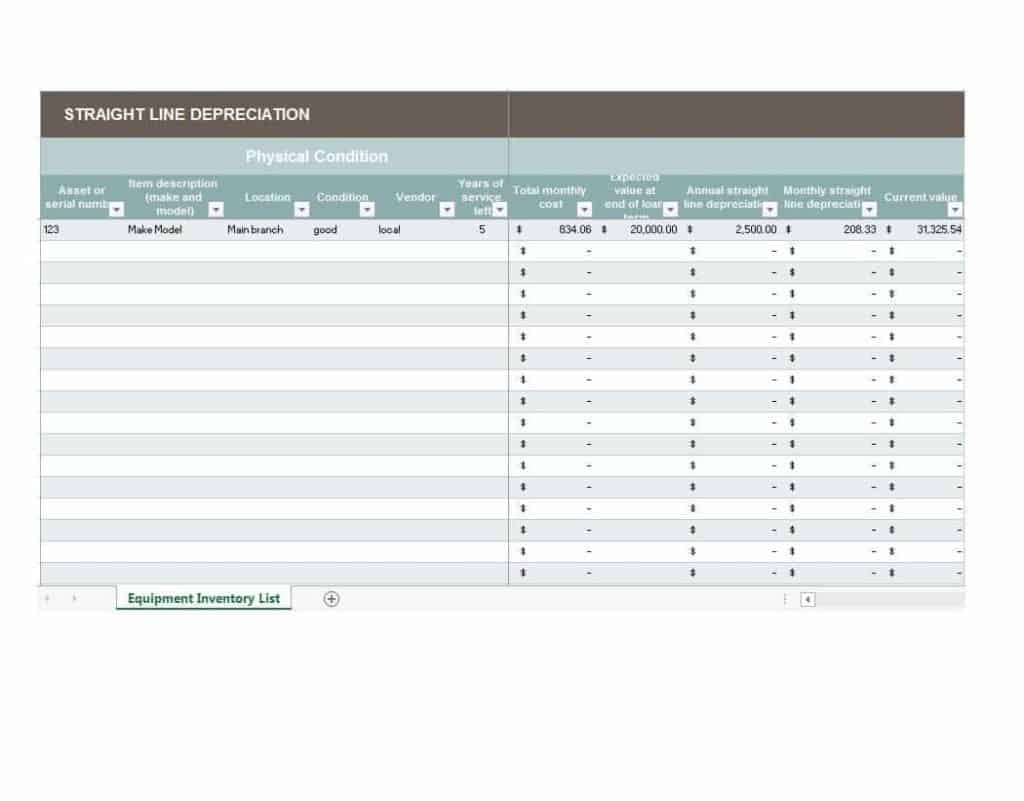

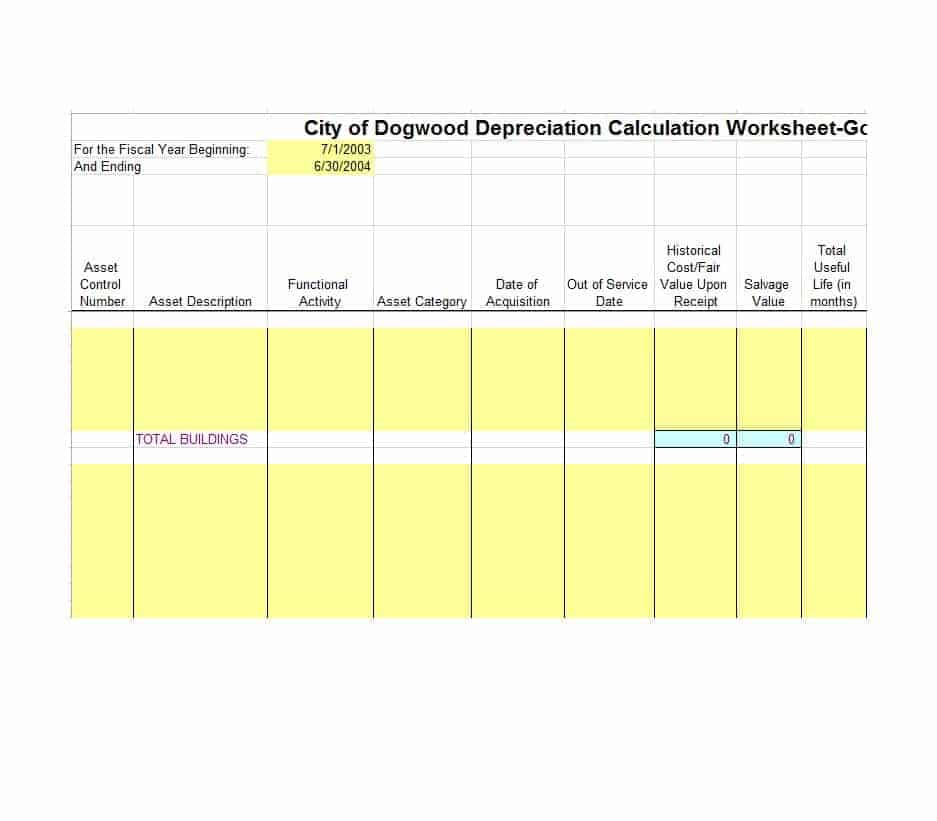

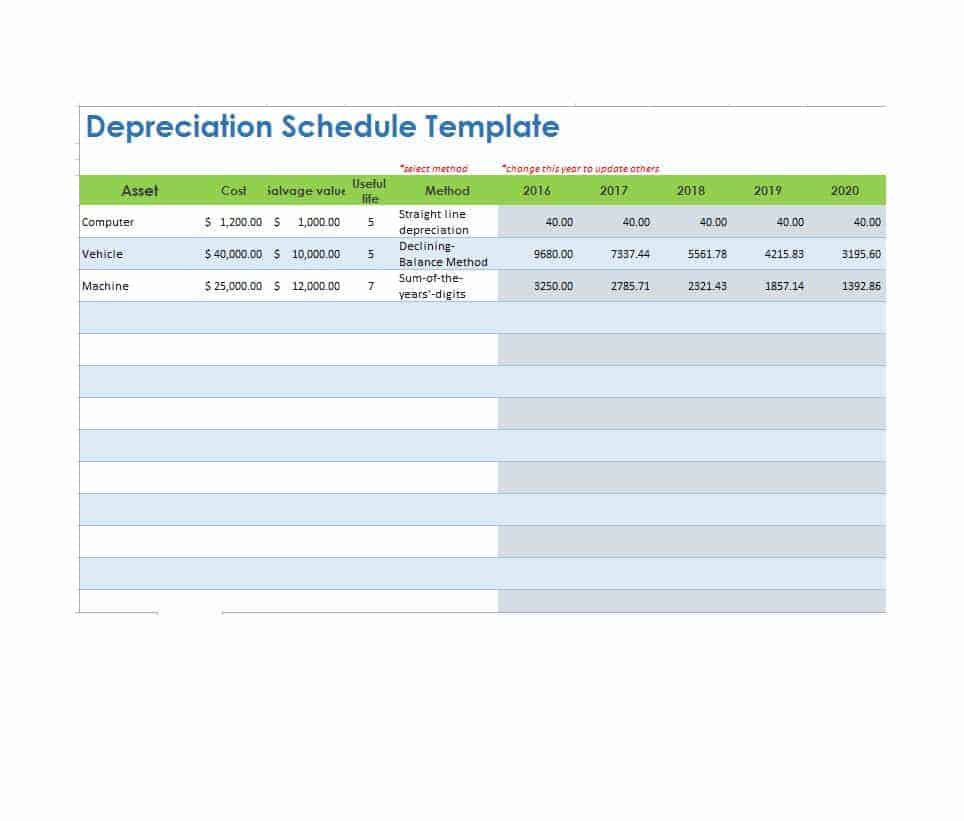

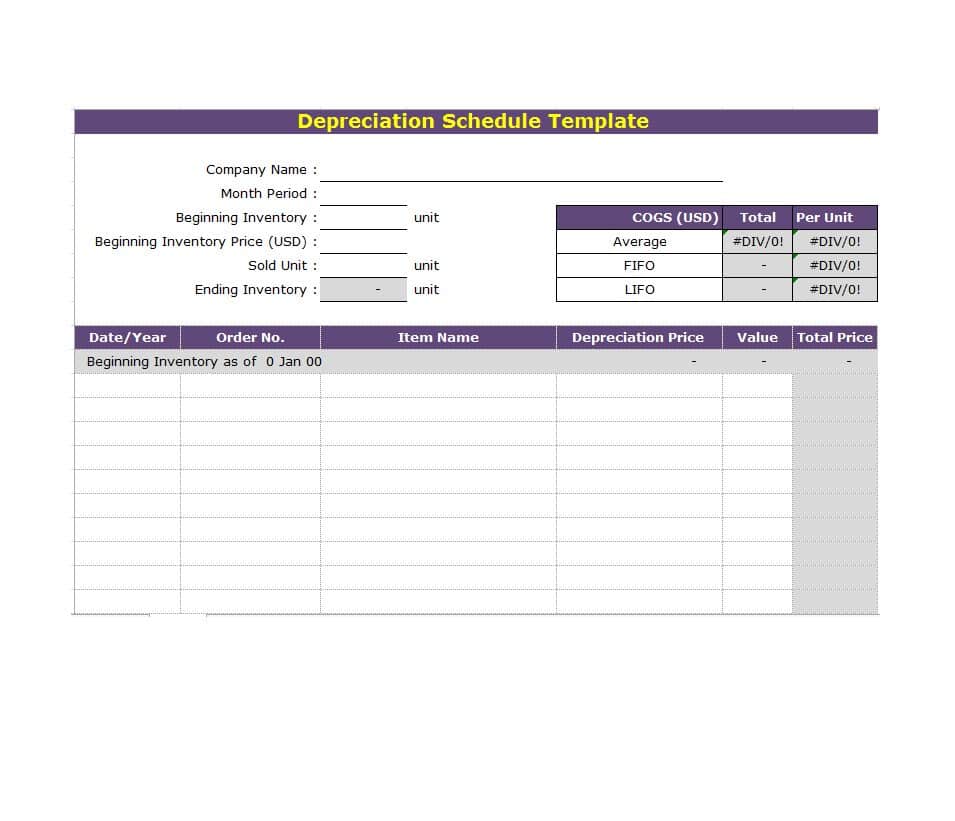

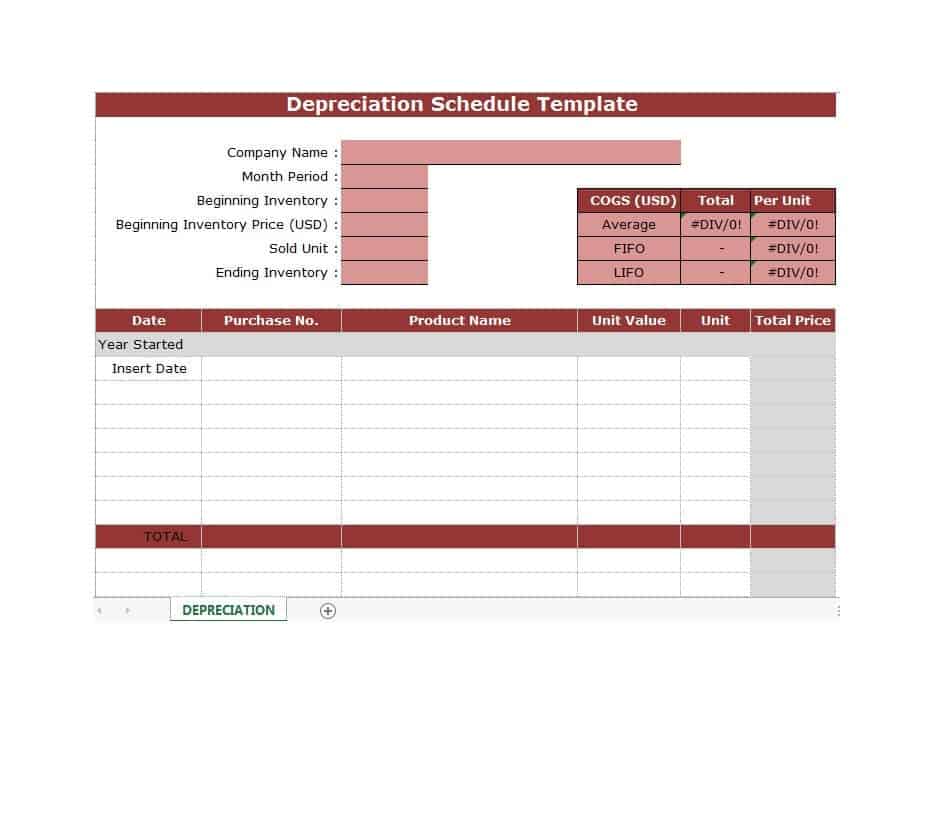

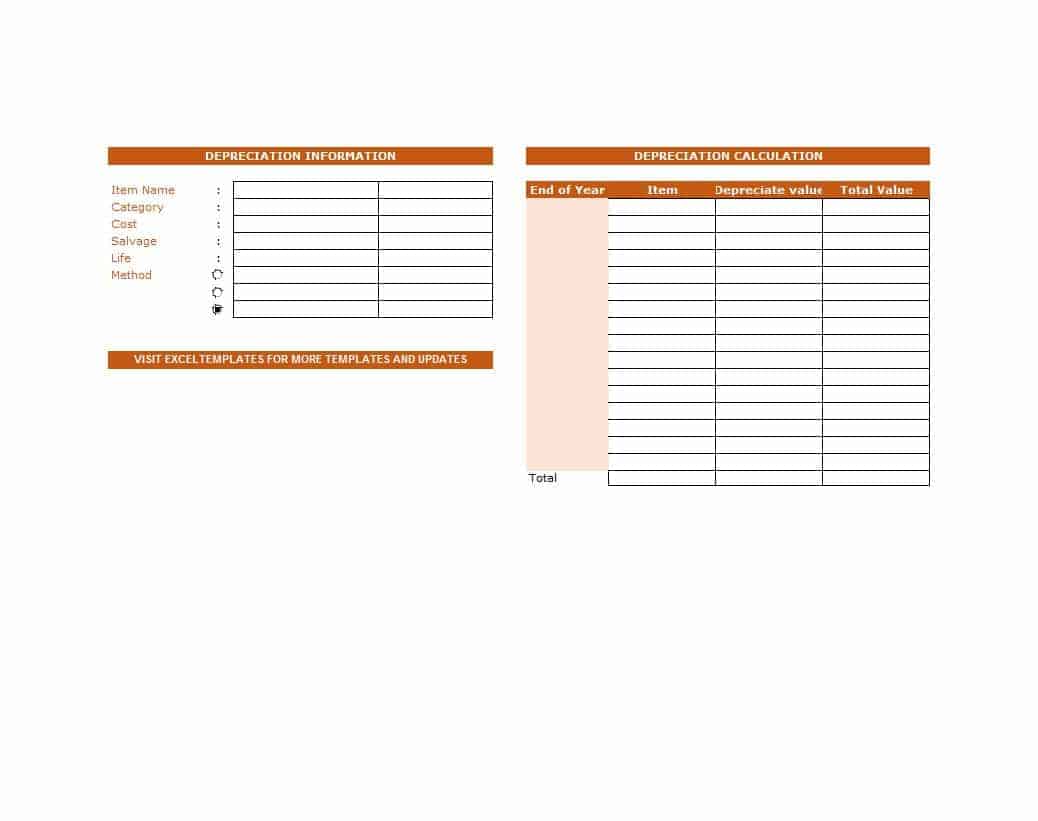

Depreciation schedule contains several methods for calculating depreciation, which are usually based on either the time frame, or the usage of the asset. These methods include straight line method, which determines the annual depreciation amount, the declining balance method (does not include salvage value), sum of years digits method, in which annual depreciation is determined by multiplying the depreciable cost by a schedule of fractions, units of production method, in which the expense rate is applied to each unit produced.

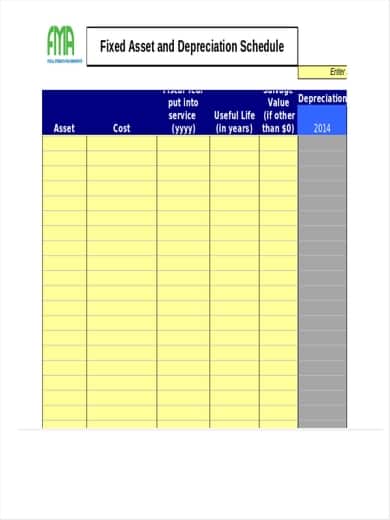

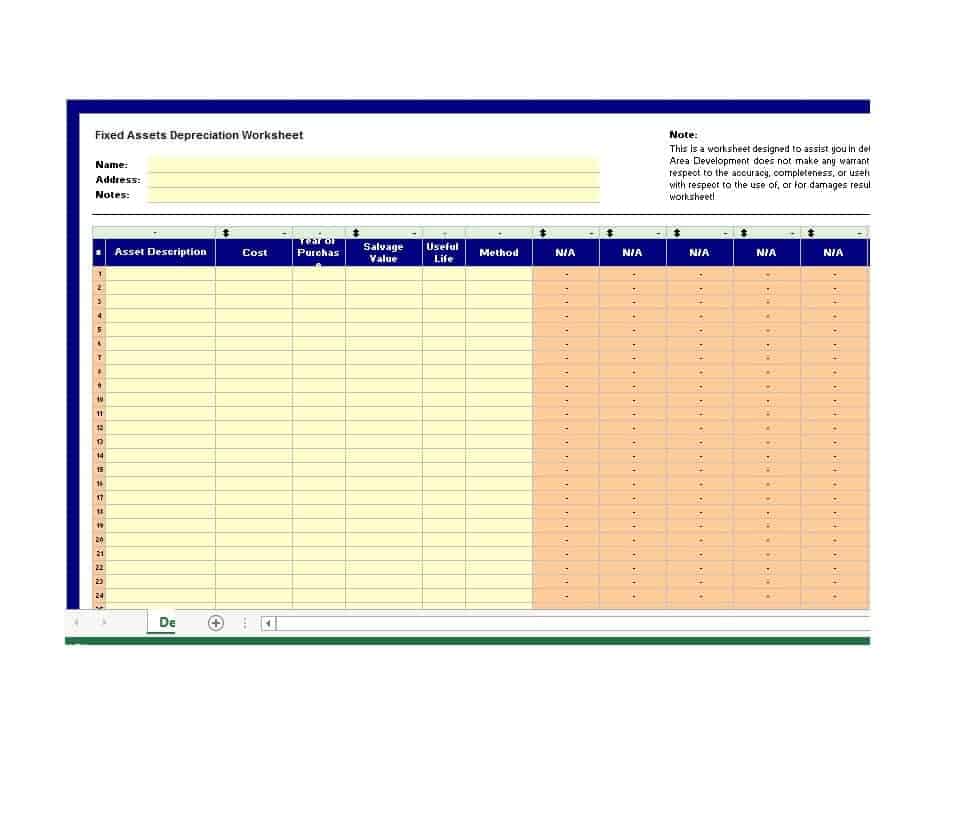

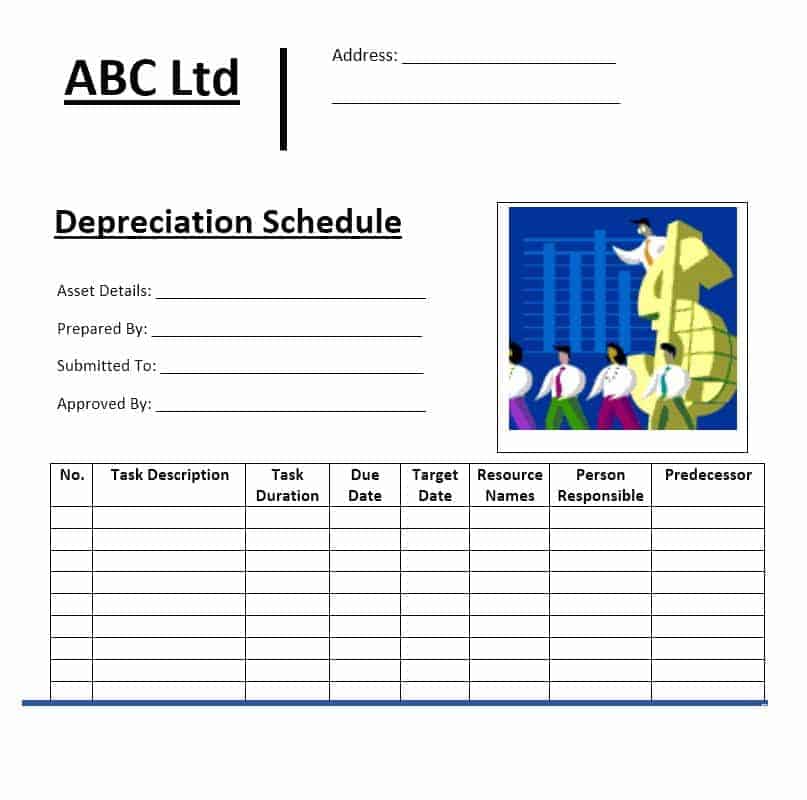

Depreciation is same as depletion and amortization, they are identical concepts for minerals and tangible assets appropriately. Depreciation schedule is used to calculate the depreciation expense and used to write-off the asset as soon as possible to increase the profitability or market value of an asset. We have added several depreciation schedule templates here for the purpose of financial reporting and formulas, for these basic depreciation common methods, you can use them at your ease to analyze the depreciation of your fixed asset by choosing any of them. These templates for depreciation schedule are created by accounting experts and loaded with all essential formulas and formats to make calculation automatic and easier. One can use these free templates for both personal and business purposes.

You must be logged in to post a comment.