A mortgage calculator is an automatic instrument or a program to calculate mortgage’s monthly payment. It is also used by mortgage donors, which enables them to determine the financial fitness or suitability of a home loan entrants. There are multiple free online mortgage calculators, and software programs that offering mortgage and financial calculations, we have given mortgage calculator excel of different types in our article, using of which you can easily estimate the payment on a new mortgage or other various purposes.

Generally, by using mortgage calculator excel, one can test different loan sizes and interest rates. Mortgage calculator excel can help you to add up all money sources and compare them to overall monthly debt payments. If you are a borrower, you can use the mortgage calculator to know how much property you could afford, whereas, a lender would be able to compare the person’s aggregate income and monthly debt load. Furthermore, it will also help you in potential mortgage payment and other relevant housing costs, like property taxes, other ownership dues etc.

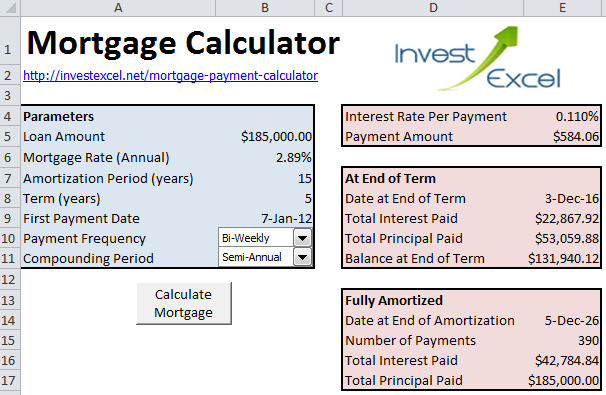

Three things you should know while you are using mortgage calculators, your monthly cost, total cost and your breakeven point. Although not all mortgage calculators include them but important when they shown up. You need to make sure that your monthly payments are fit in your budget, which means how much house you could afford and how soon you could pay it off. Your breakeven point enables you to know how long it would take for your savings to equal what you’ve spent for debt. Try our given mortgage calculators created with Microsoft excel and calculate the mortgage for a loan amount, interest rate and payment periods.